Robotic Process Automation (RPA) |

|||||||||||||||||||||||||

| 2023-04_iridium_beyond_the_buzz_-_technology_trends_-_rpa-min.pdf | |

| File Size: | 1985 kb |

| File Type: | |

Beyond the Buzz is our dynamic series of succinct articles that delve into the latest technology trends and their influence on financial institutions: by cutting through the hype, these articles offer clear, insightful perspective on how emerging technologies are shaping the financial landscape. Each piece not only explores the potential applications and benefits of these innovations but also addresses the challenges and implications for financial institutions as they navigate an ever-evolving digital environment.

0 Comments

Cloud Computing

Sky-Rocketing Investment Firm

Cloud computing is revolutionizing the financial services landscape, propelling investment firms into a new era of agility and innovation. As the industry shifts from traditional private clouds to cost-effective and infinitely scalable public clouds, financial institutions are gaining a competitive edge by embracing cutting-edge technology. From deploying applications in a flash to scaling resources on-demand, the cloud empowers investment firms to stay ahead of the game and adapt to market fluctuations like never before.

Diving into the cloud universe, investment firms can explore the various models provided by industry titans such as AWS, Azure, Google, IBM or Oracle.

These cloud services unlock a world of benefits, including turbocharged operational efficiency, seamless collaboration, unparalleled customer experience, and significant cost reductions.

Despite facing challenges such as security, compliance, and integration with legacy systems, the power of the cloud has proven irresistible. Investment firms are leveraging the cloud for a vast array of applications, including data storage and analytics, algorithmic trading, risk management, and customer relationship management. Cloud-based solutions are also reshaping regulatory compliance and reporting, collaboration, and business continuity.

In this cloud-powered age, investment firms are unlocking new opportunities, accelerating innovation, and redefining the future of finance. As cloud technology continues to evolve, the financial services industry can expect even more groundbreaking developments on the horizon.

Diving into the cloud universe, investment firms can explore the various models provided by industry titans such as AWS, Azure, Google, IBM or Oracle.

These cloud services unlock a world of benefits, including turbocharged operational efficiency, seamless collaboration, unparalleled customer experience, and significant cost reductions.

Despite facing challenges such as security, compliance, and integration with legacy systems, the power of the cloud has proven irresistible. Investment firms are leveraging the cloud for a vast array of applications, including data storage and analytics, algorithmic trading, risk management, and customer relationship management. Cloud-based solutions are also reshaping regulatory compliance and reporting, collaboration, and business continuity.

In this cloud-powered age, investment firms are unlocking new opportunities, accelerating innovation, and redefining the future of finance. As cloud technology continues to evolve, the financial services industry can expect even more groundbreaking developments on the horizon.

The full article can be downloaded from the link below:

| 2023-04_iridium_beyond_the_buzz_-_technology_trends_-_cloud_computing-min.pdf | |

| File Size: | 1980 kb |

| File Type: | |

Beyond the Buzz is our dynamic series of succinct articles that delve into the latest technology trends and their influence on financial institutions: by cutting through the hype, these articles offer clear, insightful perspective on how emerging technologies are shaping the financial landscape. Each piece not only explores the potential applications and benefits of these innovations but also addresses the challenges and implications for financial institutions as they navigate an ever-evolving digital environment.

Blockchain Technology

Safeguarding Investment Firms

Blockchain technology offers investment firms numerous opportunities, such as enhanced efficiency, increased transparency, smart contracts implementation, and improved liquidity and data management. Immediate benefits include bolstered security, reduced operational costs, and an improved customer experience. The adoption of blockchain technology could position investment firms for success in a highly competitive industry.

However, challenges must be addressed before the full potential of blockchain can be realized. These challenges include regulatory compliance, security risks, integration with existing systems, standardization, and scalability. Investment firms must navigate these obstacles carefully to effectively implement blockchain technology into their operations.

Blockchain technology has the potential to revolutionize the investment industry, providing transformative benefits and opportunities. Despite the challenges, investment firms that successfully adopt and harness the power of blockchain will be better equipped to thrive in an increasingly competitive financial landscape.

However, challenges must be addressed before the full potential of blockchain can be realized. These challenges include regulatory compliance, security risks, integration with existing systems, standardization, and scalability. Investment firms must navigate these obstacles carefully to effectively implement blockchain technology into their operations.

Blockchain technology has the potential to revolutionize the investment industry, providing transformative benefits and opportunities. Despite the challenges, investment firms that successfully adopt and harness the power of blockchain will be better equipped to thrive in an increasingly competitive financial landscape.

The full article can be downloaded from the link below:

| 2023-03_iridium_beyond_the_buzz_-_technology_trends_-_blockchain-min.pdf | |

| File Size: | 1982 kb |

| File Type: | |

Beyond the Buzz is our dynamic series of succinct articles that delve into the latest technology trends and their influence on financial institutions: by cutting through the hype, these articles offer clear, insightful perspective on how emerging technologies are shaping the financial landscape. Each piece not only explores the potential applications and benefits of these innovations but also addresses the challenges and implications for financial institutions as they navigate an ever-evolving digital environment.

Artificial Intelligence and Machine Learning

Reshaping the Future of the Investment Industry

Artificial Intelligence (AI) and Machine Learning (ML) are revolutionizing the investment industry, transforming risk management, trading, and portfolio optimization processes. Financial institutions use AI and ML to analyze large volumes of data, identify patterns, and make data-driven decisions. These technologies enable improved credit risk assessment, early warning systems, predictive analytics, fraud detection, and scenario analysis.

Investment banks, asset managers, and hedge funds are also leveraging AI and ML for faster and more efficient trading through algorithmic and high-frequency trading, predictive analytics, natural language processing, and trading automation. Additionally, these technologies can optimize investment portfolios by assisting in asset allocation, factor analysis, and the development of optimization algorithms.

However, challenges in adopting AI and ML include data quality and availability, regulatory compliance, legacy system integration, talent acquisition, and ethical concerns. Prominent industry players have successfully integrated AI and ML into their operations. As the industry continues to evolve, firms that effectively adopt and integrate these technologies will be better positioned to thrive, while those who fail to adapt may struggle to compete.

Investment banks, asset managers, and hedge funds are also leveraging AI and ML for faster and more efficient trading through algorithmic and high-frequency trading, predictive analytics, natural language processing, and trading automation. Additionally, these technologies can optimize investment portfolios by assisting in asset allocation, factor analysis, and the development of optimization algorithms.

However, challenges in adopting AI and ML include data quality and availability, regulatory compliance, legacy system integration, talent acquisition, and ethical concerns. Prominent industry players have successfully integrated AI and ML into their operations. As the industry continues to evolve, firms that effectively adopt and integrate these technologies will be better positioned to thrive, while those who fail to adapt may struggle to compete.

The full article can be downloaded from the link below:

| 2023-03_iridium_beyond_the_buzz_-_technology_trends_-_ai___ml-min.pdf | |

| File Size: | 2553 kb |

| File Type: | |

Beyond the Buzz is our dynamic series of succinct articles that delve into the latest technology trends and their influence on financial institutions: by cutting through the hype, these articles offer clear, insightful perspective on how emerging technologies are shaping the financial landscape. Each piece not only explores the potential applications and benefits of these innovations but also addresses the challenges and implications for financial institutions as they navigate an ever-evolving digital environment.

Beyond the Buzz is our dynamic series of succinct articles that delve into the latest technology trends and their influence on financial institutions: by cutting through the hype, these articles offer clear, insightful perspective on how emerging technologies are shaping the financial landscape. Each piece not only explores the potential applications and benefits of these innovations but also addresses the challenges and implications for financial institutions as they navigate an ever-evolving digital environment.

Articles will be posted in our Blog page and on LinkedIn, they will cover the following themes:

• Technology Trends, such as AI/ML, Blockchain Technology, Cloud, RegTech, ...

• Capital Markets standards such as FpML, FIX, CDM, ...

• Risk and regulatory alphabet soups such as FRTB, CCAR, PFE, DFA, ...

Articles will be posted in our Blog page and on LinkedIn, they will cover the following themes:

• Technology Trends, such as AI/ML, Blockchain Technology, Cloud, RegTech, ...

• Capital Markets standards such as FpML, FIX, CDM, ...

• Risk and regulatory alphabet soups such as FRTB, CCAR, PFE, DFA, ...

New York, March 2020 - We are pleased to announce that Ferréol de Naurois has joined back the company to reboot our consulting practice

After almost 4 years at Capgemini, where he managed the Global Capital Markets Practice and grew it 4 fold, our co-founder Ferréol de Naurois has decided to join back Iridium Consulting. A transformation and financial services expert, he brings 30 years of experience in technology services such as C-level advisory, digital transformation and execution of small to large projects for clients. With his deep level connections within the finance industry, his meticulous project delivery and 360° financial products knowledge, he will focus on growing our capacities and client base.

"I am thrilled to be back at Iridium", says Ferréol de Naurois, "and I look forward working again with our clients and hopefully former employees! While I am sad to leave the fantastic people I worked with at Capgemini, I can't wait to re-start working on projects in a more intimate setting, where you build personal relationships with employees and clients. I am also very much looking forward the agility of a startup, especially in this challenging environment."

Iridium Consulting provides consulting services and technology solutions for financial institutions. Created in 2003, Iridium has been servicing leading banks, hedge funds and asset managers in more than 15 countries. With a unique expertise in capital markets, consultants of Iridium successfully conduct a variety of projects ranging from software selection to implementation and support.

For more info, visit: http://www.iridium-consulting.com.

After almost 4 years at Capgemini, where he managed the Global Capital Markets Practice and grew it 4 fold, our co-founder Ferréol de Naurois has decided to join back Iridium Consulting. A transformation and financial services expert, he brings 30 years of experience in technology services such as C-level advisory, digital transformation and execution of small to large projects for clients. With his deep level connections within the finance industry, his meticulous project delivery and 360° financial products knowledge, he will focus on growing our capacities and client base.

"I am thrilled to be back at Iridium", says Ferréol de Naurois, "and I look forward working again with our clients and hopefully former employees! While I am sad to leave the fantastic people I worked with at Capgemini, I can't wait to re-start working on projects in a more intimate setting, where you build personal relationships with employees and clients. I am also very much looking forward the agility of a startup, especially in this challenging environment."

Iridium Consulting provides consulting services and technology solutions for financial institutions. Created in 2003, Iridium has been servicing leading banks, hedge funds and asset managers in more than 15 countries. With a unique expertise in capital markets, consultants of Iridium successfully conduct a variety of projects ranging from software selection to implementation and support.

For more info, visit: http://www.iridium-consulting.com.

Iridium Consulting Named to CIOReview’s 20 Most Promising Software Testing Solution Providers 2016

11/8/2016

FREMONT, CA—November 08, 2016 — Iridium Consulting announced today that it has been selected as one among the 20 Most Promising Software Testing Solution Providers 2016 by CIOReview.

“We are happy to announce Iridium Consulting in the latest 2016 edition of 20 Most Promising Software Testing Solution Providers,” said Jeevan George, Managing Editor of CIOReview. “Iridium Consulting delivers testing software by following industry standard methodologies that fulfill the requirements of most of the businesses.”

Iridium Consulting specializes in providing financial software, Implementation, Application Development, Application Maintenance, Production Support, and Managed Services. Its Application Release Testing (ART™) is the proprietary methodology that steers users to create meaningful test cases, combined with the “functional criticality” and “change risk” to determine the optimal test coverage. As a result, this methodology allows business and technology to agree and align on what needs to be tested for a given project and it offers a transparent framework for executing and reporting test results.

“We are happy to announce Iridium Consulting in the latest 2016 edition of 20 Most Promising Software Testing Solution Providers,” said Jeevan George, Managing Editor of CIOReview. “Iridium Consulting delivers testing software by following industry standard methodologies that fulfill the requirements of most of the businesses.”

Iridium Consulting specializes in providing financial software, Implementation, Application Development, Application Maintenance, Production Support, and Managed Services. Its Application Release Testing (ART™) is the proprietary methodology that steers users to create meaningful test cases, combined with the “functional criticality” and “change risk” to determine the optimal test coverage. As a result, this methodology allows business and technology to agree and align on what needs to be tested for a given project and it offers a transparent framework for executing and reporting test results.

About Iridium Consulting

Iridium provides consulting services and technology solutions for financial institutions. Created in 2003, Iridium has been servicing leading banks, hedge funds and asset managers in more than 15 countries. With a unique expertise in capital markets, consultants of Iridium successfully conduct a variety of projects ranging from software selection to implementation and support. For more info, visit: http://www.iridium-consulting.com/

About CIOReview

Published from Fremont, California, CIOReview is a print magazine that explores and understands the plethora of ways adopted by firms to execute the smooth functioning of their businesses. A distinguished panel comprising of CEOs, CIOs, IT VPs including CIOReview editorial board finalized the “20 Most Promising Software Testing Solution Providers 2016” in the U.S. and shortlisted the best vendors and consultants. For more info: http://www.cioreview.com/

New York, September 2016 – Iridium Consulting has established a close relationship with Capgemini to join forces and provide advanced trading solution capabilities to our Capital Markets clients.

Iridium’s focus on Capital Markets technologies complements the wide range of services globally offered by Capgemini. The goal is to help clients in the selection and implementation of front-to-back cross asset trading solutions.

Iridium and Capgemini practices have established numerous partnerships with leading vendors and Fintech companies in addition to working on bespoke software solutions.

Our clients will benefit from the depth of subject matter expertise and industry best practices to rapidly and efficiently transform their technologies to comply with regulatory frameworks, reduce cost through automation and capture new market opportunities.

Iridium and Capgemini practices have established numerous partnerships with leading vendors and Fintech companies in addition to working on bespoke software solutions.

Our clients will benefit from the depth of subject matter expertise and industry best practices to rapidly and efficiently transform their technologies to comply with regulatory frameworks, reduce cost through automation and capture new market opportunities.

About Capgemini

With more than 180,000 people in over 40 countries, Capgemini is a global leader in consulting, technology and outsourcing services. The Group reported 2015 global revenues of EUR 11.9 billion. Together with its clients, Capgemini creates and delivers business and technology solutions that fit their needs, enabling them to achieve innovation and competitiveness. A deeply multicultural organization, Capgemini has developed its own way of working, the Collaborative Business ExperienceTM, and draws on Rightshore®, its worldwide delivery model.

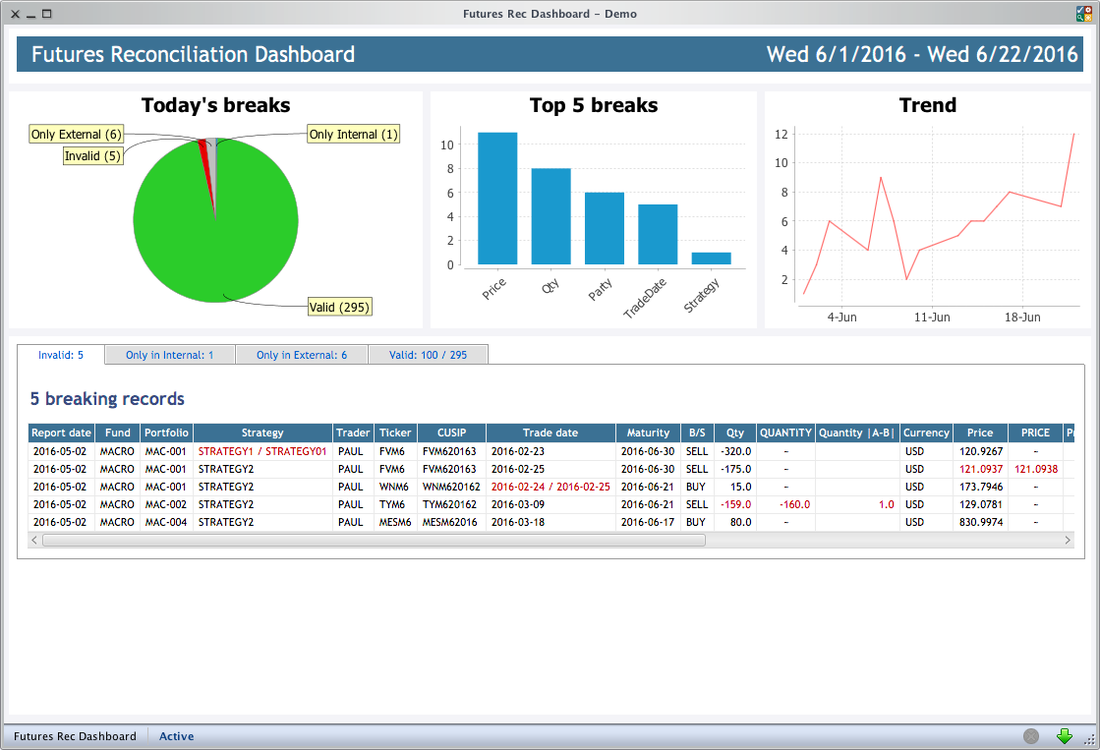

Monitor your sensitive reconciliations using this realtime out-of-the-box reconciliation dashboard.

Available in BackStage v2.6!

Available in BackStage v2.6!

Iridium is pleased to announce the release of BackStage 2.6, our innovative reconciliation and data quality software.

BackStage™ delivers a robust data solution that stands out for its functionalities and user friendliness. This highly agile development framework promotes efficiency and reduces cost.

The standalone edition offers individual developers and data analysts a perfect tool for prototyping and implementing reconciliations, data quality checks, automatic data corrections, statistical analysis and much more.

For organizations, the workgroup edition offers a centralized development and runtime framework that includes enterprise features such as LDAP integration, Oracle RAC™...

BackStage™ delivers a robust data solution that stands out for its functionalities and user friendliness. This highly agile development framework promotes efficiency and reduces cost.

The standalone edition offers individual developers and data analysts a perfect tool for prototyping and implementing reconciliations, data quality checks, automatic data corrections, statistical analysis and much more.

For organizations, the workgroup edition offers a centralized development and runtime framework that includes enterprise features such as LDAP integration, Oracle RAC™...

Author

The Iridium Team

Archives

March 2023

March 2020

November 2016

September 2016

June 2016

April 2016

RSS Feed

RSS Feed